Unauthorized

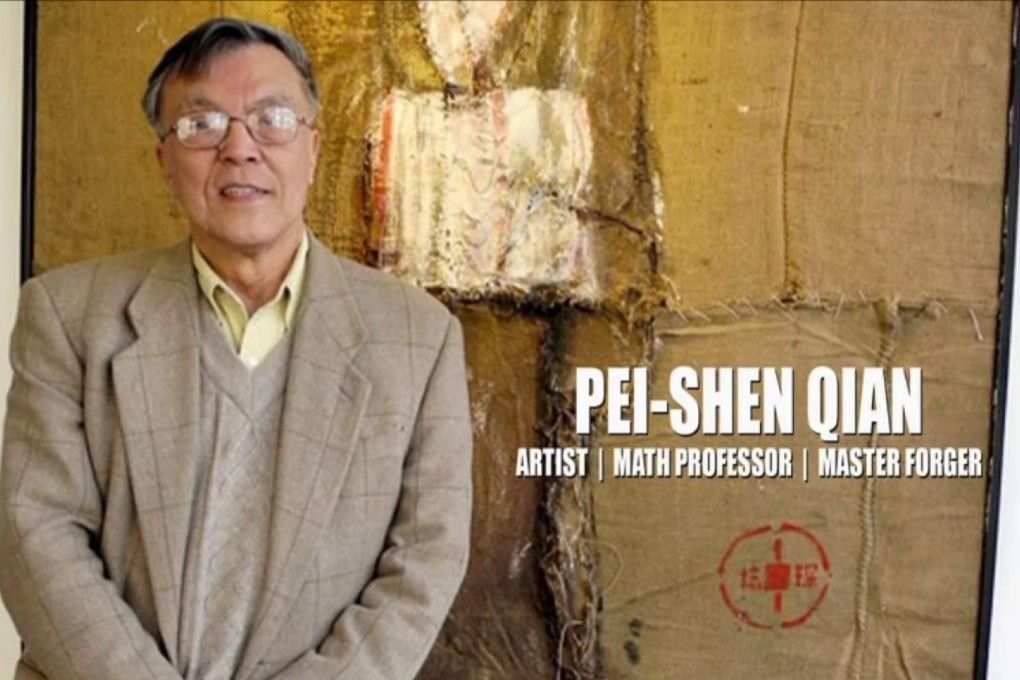

Artful Deception: The Knoedler Gallery Forgeries

This story isn't about a single individual, but rather a long-running and elaborate art forgery scheme that duped the art world for decades.

The Gallery with a Reputation:

The Knoedler Gallery was a prestigious art gallery in New York City, established in 1846. Its reputation for authenticity and expertise attracted high-profile collectors and museums. This established trust would become the foundation for a shocking scandal.

The Forger and the Mastermind:

Wolfgang Beltracchi, a talented artist with a mischievous streak, began creating forgeries of abstract expressionist works by renowned artists like Jackson Pollock and Mark Rothko. He meticulously researched techniques and materials, ensuring his forgeries were near-flawless. Joining forces with art dealer Ochsprung, they orchestrated the sale of these forgeries through the Knoedler Gallery.

The House of Cards Crumbles:

The scheme ran smoothly for years, with millions of dollars changing hands. However, doubts began to arise as some art experts noticed inconsistencies in the paintings. A forensic investigation ultimately exposed the elaborate forgeries, sending shockwaves through the art world.

Aftermath and Impact:

Beltracchi and Ochsprung were convicted of fraud and sentenced to prison. The Knoedler Gallery, once a pillar of the art world, faced lawsuits and a damaged reputation. The case highlighted the vulnerability of the art market to forgery and the need for stricter authentication procedures.

Beyond the Fakes:

This story delves into the complexities of art authentication and the lengths people will go to for personal gain or notoriety. It raises questions about the value we place on art and the trust bestowed upon established institutions.

The "Queen of Crypto": Ruja Ignatova and the OneCoin Ponzi Scheme

The world of cryptocurrency has its own share of scams, and OneCoin stands out as one of the most audacious. Ruja Ignatova, the self-proclaimed "Queen of Crypto," orchestrated a multi-billion dollar Ponzi scheme that lured in investors with promises of unimaginable wealth.

The Rise of a Cryptocurrency Queen:

Ruja Ignatova burst onto the scene in 2014, claiming OneCoin was a revolutionary new cryptocurrency. She captivated audiences with her charismatic presentations, promising OneCoin would become the "Bitcoin killer." Lavish events and celebrity endorsements fueled the hype, attracting investors worldwide.

The House of Lies:

However, OneCoin was never a real cryptocurrency. It lacked the underlying technology of legitimate cryptocurrencies and had no real-world use case. The promised returns were simply paid out with funds from new investors, a classic hallmark of a Ponzi scheme.

The Disappearance and the Fallout:

In 2017, Ignatova mysteriously vanished, just before authorities began investigating OneCoin. Despite her absence, the scheme continued to operate for a while, but it eventually collapsed. Thousands of investors lost their money, and the company's leaders face serious criminal charges.

The Legacy of OneCoin:

The OneCoin saga serves as a cautionary tale for the cryptocurrency space. It highlights the importance of investor education and the need to be wary of charismatic leaders and unrealistic promises. It also raises questions about the regulatory framework surrounding cryptocurrencies.

Beyond the Scam:

The story of Ruja Ignatova is as much about manipulation as it is about fraud. Her ability to convince investors to part with their money, despite the lack of a real product, is a chilling reminder of the power of persuasion and the human desire for quick wealth.

The Rise and Fall of Fyre Festival: A Social Media Scam Exposed

The Hype Machine:

Fyre Festival wasn't just about selling tickets; it was about creating an irresistible image. Billy McFarland, the festival organizer, partnered with rapper Ja Rule to leverage social media influencer marketing. A barrage of perfectly curated photos flooded Instagram. Models like Bella Hadid and Emily Ratajkowski posed on pristine beaches, with captions hinting at a luxurious, exclusive event. The festival website offered little detail, but the influencer posts fueled a frenzy.

The Cracks Begin to Show:

As the event neared, some attendees grew suspicious. Luxury villas promised on the website turned out to be flimsy tents. Catered meals transformed into cheese sandwiches delivered in white vans. Disorganized planning and a lack of basic amenities like working toilets were evident. Social media, once a tool for promotion, became a platform for exposing the disaster unfolding.

The Fallout:

The festival was a complete fiasco. Stranded attendees documented their experience online, turning Fyre Festival from a hyped event into a viral symbol of social media deception. McFarland was convicted of fraud and sentenced to prison. The story served as a wake-up call for the influencer marketing industry, highlighting the need for transparency and accountability.

Lessons Learned:

Don't be blinded by social media. A curated image online doesn't always reflect reality.

Do your research. Investigate an event or product before investing. Look beyond influencer posts and seek out independent reviews.

If something seems too good to be true, it probably is. Be skeptical of extravagant promises and a lack of details.

The Fyre Festival debacle serves as a reminder of the power and limitations of social media. It's important to be a discerning viewer and avoid falling prey to online hype.

Bernie Madoff: The Wall Street Wizard Who Unraveled Trust

Bernard "Bernie" Madoff wasn't your typical Wall Street villain. He cultivated an aura of respectability, leading a prominent investment firm for decades. However, beneath the surface lurked a meticulously crafted Ponzi scheme that would become the largest financial fraud in history. Let's delve into the world of Bernie Madoff, where trust was a carefully constructed illusion.

The Trusted Advisor:

Madoff's firm, Bernard L. Madoff Investment Securities, was established in the 1960s. He built a reputation for exclusivity, managing money for wealthy individuals, celebrities, and even charitable foundations. Madoff promised consistent, high returns – a claim that seemed almost too good to be true, but one that enticed investors seeking a safe haven for their wealth.

The House of Cards Built on Lies:

The reality was far from rosy. Madoff wasn't generating exceptional returns through legitimate investments. He was orchestrating a colossal Ponzi scheme. Early investors' returns were paid out of funds from new investors. Madoff meticulously controlled the flow of money, creating the illusion of success. This deceptive cycle continued for decades, fueled by trust and Madoff's carefully cultivated image as a financial genius.

The Unraveling and the Aftermath:

The 2008 financial crisis exposed the house of cards. As investors sought to withdraw their funds, Madoff's scheme unraveled. In 2008, he confessed to his sons, who then reported him to authorities. The magnitude of the fraud was staggering – an estimated $64.8 billion lost. Thousands of individuals, charities, and institutions saw their life savings vanish. Madoff was sentenced to 150 years in prison, but the emotional and financial devastation he caused continues to be felt by his victims.

A Legacy of Broken Lives:

The Madoff scandal shattered trust in the financial system and exposed the vulnerability of investors to seemingly reputable figures. It highlighted the need for stricter oversight and investor education. Madoff's story serves as a tragic reminder of the human cost of greed and the importance of due diligence in the world of finance.

Enron: The Texan Titans Tainted by a Tower of Lies

Enron. The name synonymous with corporate greed and a spectacular fall from grace. In the heart of Texas, a company once hailed as an energy innovator transformed into a cautionary tale of deception and financial manipulation. Here's a deeper look at the Enron saga, with context that exposes the cracks beneath the dazzling facade.

The Rise of the Renegades:

Enron wasn't always a behemoth. Founded in the 1980s through the merger of two natural gas pipeline companies, it rose to prominence under the leadership of Kenneth Lay and Jeffrey Skilling. They cultivated an image of brash, innovative executives, challenging the status quo in the energy industry. Enron embraced deregulation in the 1990s, venturing beyond pipelines and into electricity trading, broadband services, and even weather derivatives – a complex financial instrument tied to weather patterns.

The Facade of Success:

Enron's stock price soared throughout the 1990s. Wall Street analysts lauded them, and media outlets dubbed them "the most innovative company in America." But behind the glossy veneer lurked a dark secret – a web of accounting tricks orchestrated by CFO Andrew Fastow and his team. Enron used "Special Purpose Entities" (SPEs), essentially off-the-books partnerships, to hide massive debts and inflate profits. These SPEs were loaded with Enron stock at inflated prices, making Enron's financial health appear much rosier than it was.

The House of Cards Crumbles:

The elaborate scheme couldn't last forever. Journalists and analysts began questioning Enron's skyrocketing profits and murky financial statements. Sherron Watkins, an Enron employee, bravely blew the whistle on the accounting fraud. The tide began to turn. Investors lost confidence, the stock price plummeted, and in December 2001, Enron filed for bankruptcy. The company's collapse sent shockwaves through the financial world, wiping out billions of dollars in investments and leaving thousands of employees jobless.

Aftermath: A Legacy of Broken Trust:

The Enron scandal exposed the dangers of unchecked ambition and a culture that prioritized short-term profits over ethical practices. Lay, Skilling, and Fastow were all convicted of fraud and sentenced to prison. The fallout also led to stricter regulations on accounting practices and corporate governance. Enron's story serves as a stark reminder of the importance of transparency, accountability, and the potential consequences of prioritizing greed over ethical business practices.